How much do you spend a month on subscriptions? I have been looking at my YNAB category for monthly subscriptions and I’ve noticed it is getting a little out of hand. Subscriptions have been around forever; from magazines to monthly deliveries of goodies and snacks, subscriptions are a convenient way to get what you want delivered to you for a fee.

The problem is, those subscriptions can add up. I have always had a personal love-affair with subscriptions. I love my Amazon Prime, for all the services I get and the free shipping alone, I think it is totally worth the annual fee. But there are other subscriptions I have had that were just a convenience and wasted money. At one time or another, (not all at once) I have had television streaming subscriptions, beauty sample subscriptions, fitness apps, ancestry.com, an audible book subscription, kindle unlimited, Blue Apron and my cable and internet, which most consider a subscription service. If you total that up that is $325 a month in subscription services. WHOA!!! That’s a lotta moolata!!

A s it is now, I have cancelled all my services.

s it is now, I have cancelled all my services.

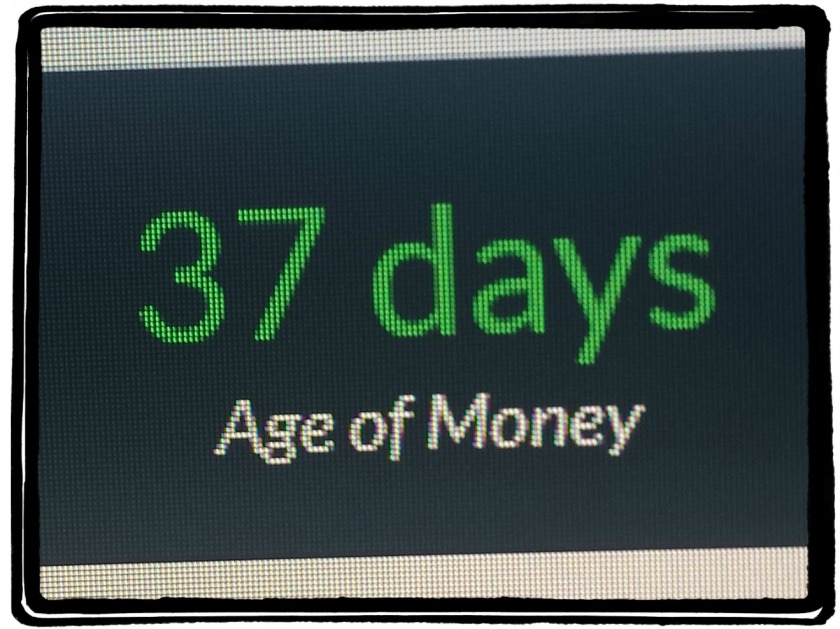

It will be nice to take that extra $300 a month and stick it into my growing buffer. I even decided for the summer to cancel Blue Apron, we will be so busy that quick wraps and fresh fruit will be our main meal; plus if you live in a humid environment like me, you’ve got to be crazy to turn your oven on in the summer.

Cable and Internet is something that all financial gurus suggest you cancel; they almost make you feel guilty for having it! Yes, you can save $1200 or more a year if you don’t have it. Yes, you have so much more time to do things without mindlessly staring at your television. Yes, you can get streaming subscriptions that are cheaper than cable. Blah, blah, blah… I am financially secure enough, I’m keeping it, and I regret nothing!

Here’s the thing, if you have a service that you absolutely love, something you feel is totally worth the money and something you use every day and it doesn’t affect your bottom line, keep it! After all, it’s your money, don’t let people make you feel guilty how you use it. My rule is “How many hours do I have to work to pay for this? Is it worth my time?” That’s how I make many of my decision. I hope it helps you as well.